You want to know what your domain is worth. Not later. Now.

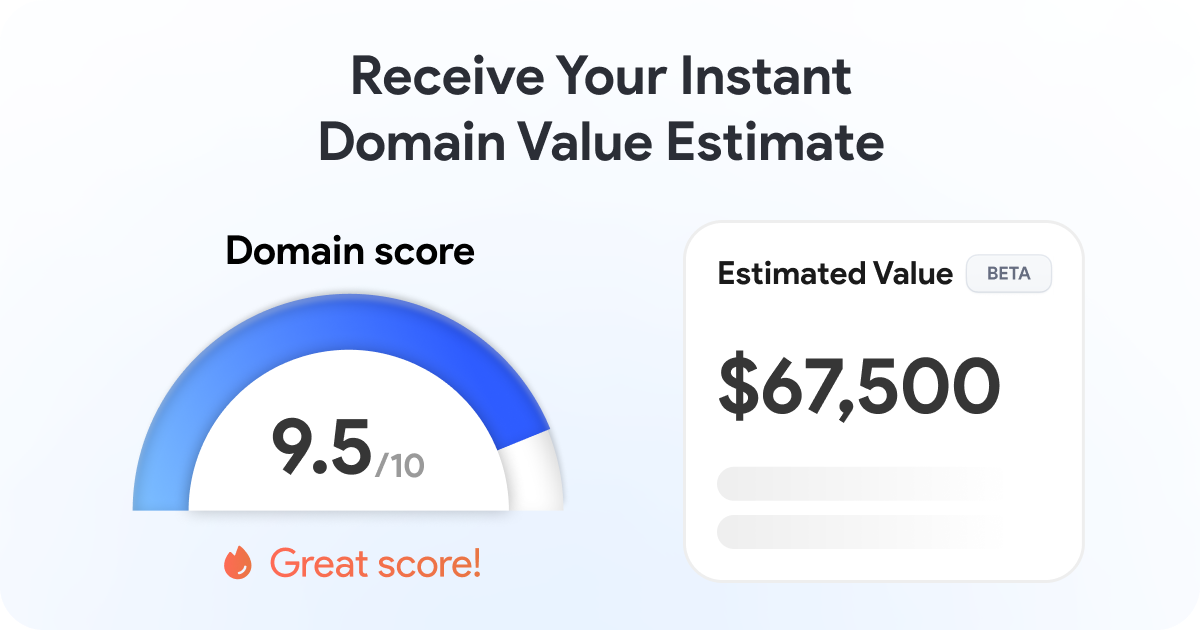

A modern domain valuation tool gives you instant insight based on market data, keyword strength, and historical sales trends. But speed alone isn’t enough. You need accuracy backed by real numbers.

In 2024, the global domain aftermarket recorded over $180 million in publicly reported sales, according to NameBio. Premium .com domains continue leading, but AI and tech-driven keywords surged in value through 2025.

If you price blindly, you leave money on the table. If you overprice, you lose buyers. Here’s how to get it right.

Why Instant Domain Value Analysis Matters

Domains move fast. Startups launch daily. Investors buy in bulk. Trends shift overnight.

You can’t wait weeks for appraisal feedback.

A proper tool analyzes:

- Keyword demand

- Search volume trends

- Cost-per-click data

- Comparable historical sales

- Extension performance

You get a clear pricing range within seconds.

As Andrew Allemann explains, “The domain market runs on data. Buyers look at comparables before making serious offers.” That means you should too.

Speed Without Context Is Dangerous

Some tools generate inflated numbers with no explanation. That hurts credibility when negotiating with buyers.

You need:

- Transparent metrics

- Market comparables

- Industry alignment

Instant should still mean informed.

What Impacts Domain Market Worth in 2025

Not all domains are equal. Value depends on measurable factors.

1. Extension Strength

.com remains dominant. According to Verisign, .com and .net combined surpassed 170 million registrations in 2024.

Other extensions like .ai and .io gained traction, especially in tech. But liquidity still favors .com.

2. Keyword Commercial Intent

High-intent keywords in finance, SaaS, AI, and cybersecurity command stronger resale value.

If advertisers spend heavily on a keyword, buyers often pay more for matching domains.

3. Length and Brandability

Shorter domains sell faster. One-word .com domains often reach six or seven figures. Clean two-word brandables dominate the mid-four to five-figure range.

Clarity sells. Complexity doesn’t.

How a Domain Value Analysis Tool Works

You enter a domain. The tool scans multiple signals.

Data Points Typically Evaluated

- Search demand trends

- CPC benchmarks

- Industry competition

- Past domain sales

- Extension performance

- Length and structure

It then generates a realistic price range.

Why Comparable Sales Matter Most

Professional investors price domains like real estate. They compare similar sales.

Public marketplaces such as Sedo and GoDaddy influence market benchmarks because their transactions reflect real buyer demand.

If similar domains sold between $8,000 and $15,000 recently, that range becomes your starting point.

Common Mistakes When Estimating Domain Worth

You can avoid these.

Overrelying on One Metric

High search volume alone doesn’t guarantee value. You need commercial intent and brand potential.

Ignoring Market Timing

AI-related domains surged between 2023 and 2025. Crypto cooled after peak hype cycles. Trends affect pricing.

Pricing Emotionally

You may love your domain. Buyers don’t care about sentiment. They care about ROI.

Stay objective. Let data lead.

When to Trust the Estimate and When to Adjust

Tools give ranges. Negotiation defines the final number.

You should adjust upward if:

- Multiple buyers show interest

- The keyword sits in a booming sector

- The domain fits a funded startup niche

You should adjust downward if:

- Demand signals are weak

- Extension lacks liquidity

- Comparable sales trend lower

Smart pricing increases deal closure rates.

Why Data-Driven Investors Win

The domain market rewards discipline.

Serious investors analyze:

- Comparable sales

- Market cycles

- Keyword economics

- Liquidity strength

They don’t guess. They validate.

According to industry reports from DNJournal, enterprise buyers continue driving high-value acquisitions in SaaS and fintech. That confirms one thing. Strong commercial keywords maintain demand.

If you want consistent returns, you follow data. Not hype.

A reliable domain valuation tool gives you speed. Historical sales data gives you accuracy. Market context gives you confidence.

When you combine all three, you price strategically.

That protects your asset. It strengthens negotiations. And it increases your chance of closing profitable deals.

You don’t need guesswork. You need evidence.